Picture supply: Getty Photos

The FTSE 100 incorporates some high-yield shares proper now, from British American Tobacco to Aviva. However the FTSE 250 index of smaller and medium-sized corporations additionally incorporates members with excessive figures.

In truth, one at the moment gives an 8.6% yield – increased than both British American Tobacco or Aviva in the mean time.

Ought I to purchase it for my portfolio?

Effectively-known title, of kinds

The corporate in query is Normal Life Aberdeen. Or at the very least it was, earlier than shedding its vowels to turn out to be abrdn (LSE: ABDN). It’s not simply the vowels that bought misplaced – its shares have fallen near 40% since that title change was introduced in April 2021, and are down 26% over the previous yr alone.

However that interval has been difficult for the funding business in some ways. abrdn shares are down simply 3% this yr and have rallied a formidable 25% over the previous three months. On prime of that, the 8.6% dividend yield seems to be juicy to me.

So, might this be a inventory value including to my portfolio?

A number of challenges however long-term promise

The title change bothers me partly as a result of a well known and recognisable model generally is a worthwhile asset for a monetary companies firm. Thankfully, abrdn does nonetheless have a wide range of sturdy belongings, from well-recognised working manufacturers to a sizeable buyer base.

Within the first quarter of this yr, it reported belongings below administration and administration of over half a trillion kilos, a rise over the identical quarter final yr.

Final yr the primary quarter noticed a pointy internet outflow of funds. However this time round, that quantity was constructive, that means shoppers put in additional funds than they withdrew.

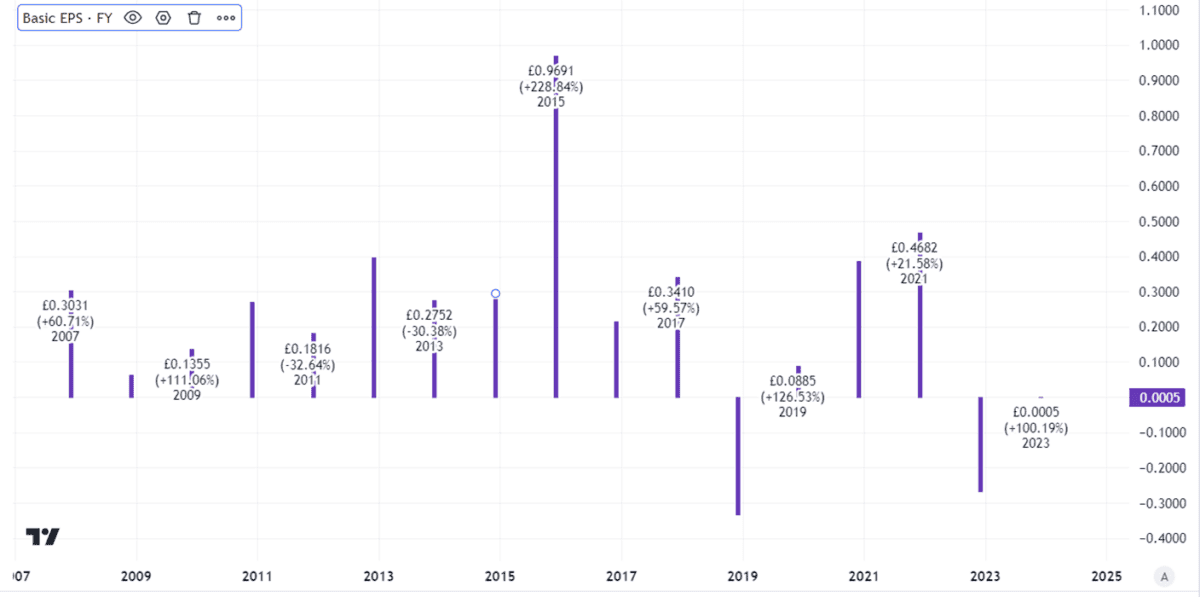

That kind of consumer base might be the premise of a worthwhile enterprise. abrdn’s fundamental earnings per share have moved round rather a lot, together with some losses. However over time the agency has demonstrated that its enterprise does have the potential to generate sizeable income when doing nicely.

Created utilizing TradingView

Certainly, the present price-to-earnings ratio of 12 seems to be pretty low cost – however the firm is buying and selling on lower than 4 occasions 2021 earnings. Which means it may very well be a cut price if it will probably repair a few of its current challenges.

They embrace shoppers pulling funds out throughout the business as an entire (an element that affected abrdn final yr) and attaining constant profitability. A value-cutting programme is in place to try to assist with that – however, as all the time, cost-cutting generally is a dangerous enterprise if it upsets shoppers or employees.

Excessive-yield dividend inventory

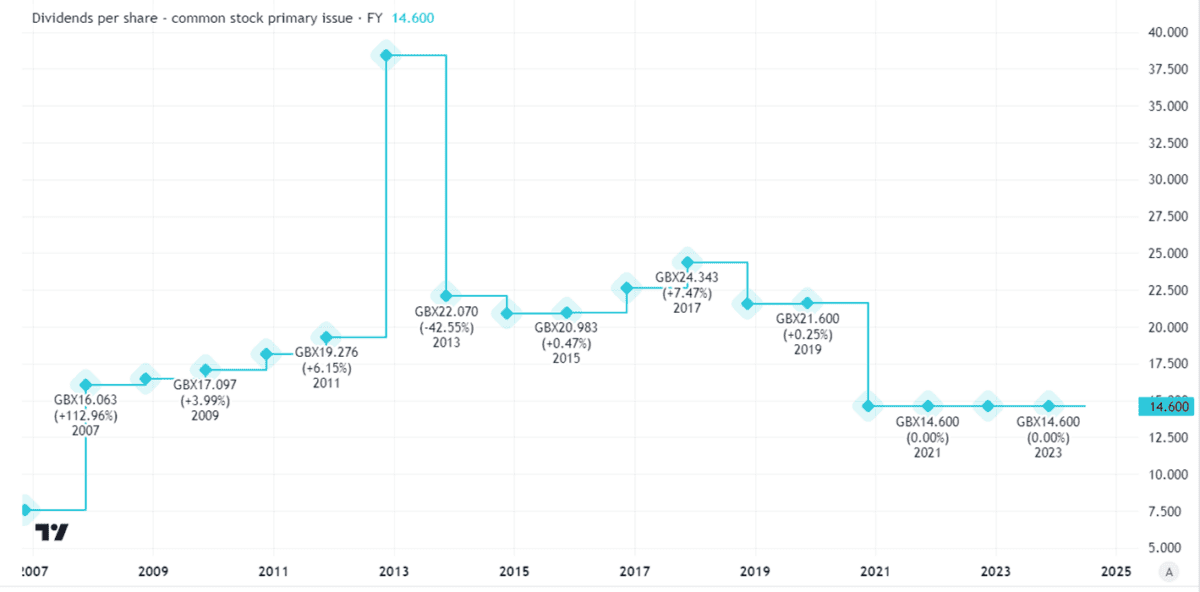

These challenges have seen the FTSE 250 agency maintain its dividend per share flat lately after a giant lower in 2020.

Created utilizing TradingView

Nonetheless, even when the dividend is held flat, that 8.6% yield seems to be enticing to me.

The priority I’ve is that the enterprise has been an inconsistent performer over a few years. There’s a purpose the dividend is smaller than it was over a decade in the past.

I believe there are ongoing dangers, notably if an financial downturn hurts consumer demand, so for now I can’t be investing.

![Just released: Share Advisor's latest lower-risk, higher-yield recommendation [PREMIUM PICKS]](https://getmoneyskills.net/wp-content/uploads/2024/04/Just-released-Share-Advisors-latest-lower-risk-higher-yield-recommendation-PREMIUM-PICKS-150x150.jpg)